The provision refers to a liability whose amount and timing of occurrence are not definite. We create provisions as a charge against profit so as to meet the loss or decrease in the asset’s value. It is a liability that one can measure with a substantial degree of estimation.

The provision refers to a liability whose amount and timing of occurrence are not definite. We create provisions as a charge against profit so as to meet the loss or decrease in the asset’s value. It is a liability that one can measure with a substantial degree of estimation.

But contingent liability, is not a real liability. This is because it is not predictable that there will be a need for an outflow of financial resources to settle obligations. Hence, the confirmation of the existence of this liability will take place on the happening or non-happening of one or more uncertain future events. These events are not completely within the control of the enterprise.

In this post, we will educate you on the difference between provision and contingent liability.

Content: Provision Vs Contingent Liability

Comparison Chart

| Basis for Comparison | Provision | Contingent Liability |

|---|---|---|

| Meaning | Provision is a present liability whose amount is uncertain. One can measure it reliably using a substantial degree of estimation. | A contingent liability is a possible obligation that may or may not emerge, depending on the occurence or non-occurence of future events. |

| Estimated Amount | Largely Certain | Uncertain |

| Recognized | Yes | No |

| Occurence of Event | Certain | Conditional or uncertain |

| Accounted for | Provision is accounted for at present and occurs as a result of past event. | Contingent Liability is recorded at present, as a note, to account for outflow of funds which are likely to occur in future. |

What is Provision?

Companies often earmark (save) a certain sum of money out of profit to meet any expenditure or loss whose value estimation is not possible with considerable accuracy. This is what we call provision. The amount is retained to provide for depreciation, renewal of asset or diminution in its value, or any known liability whose amount is not known.

To put simply, provision is an arrangement for those expenses or losses which belong to the current accounting period, but the sum is not predictable with surety because it has not yet been incurred. Therefore, it is necessary to make provisions for these items to ascertain the real net profit.

Every year a certain sum is charged out of the profit and loss account to meet the contingency. The provision account needs to be posted compulsorily at the debit side of the profit and loss account, irrespective of the fact that the firm earns a profit or incurs a loss.

Characteristics of Provisions

- Firms create provisions to meet any known liability whose amount is not certain. So, if the determination of the amount of liability is possible with reasonable accuracy, it comes under liability and not provision.

- It is a charge against profit. It decreases the net profit of the financial year in which the firm creates provisions.

- Creation of provision is by debiting the profit and loss account before calculating the amount of net profit.

- The creation of a provision is a legal requirement. Its creation is compulsory even when there are losses.

- The firm cannot invest the amount of provision outside the business.

- The firm cannot use the amount of provision as divisible profit. It must use the amount for the purpose for which its creation took place.

Example

Suppose a shopkeeper sells goods on credit to his customers. He is certain that some of his customers, i.e. debtors of the current period, would not repay the sum or would pay partially.

Hence, it is important to consider this expected loss at the time of calculating the profit and loss for the period. So, for this purpose, the shopkeeper creates provisions for doubtful debts. Further, we do so to follow the Principle of Prudence.

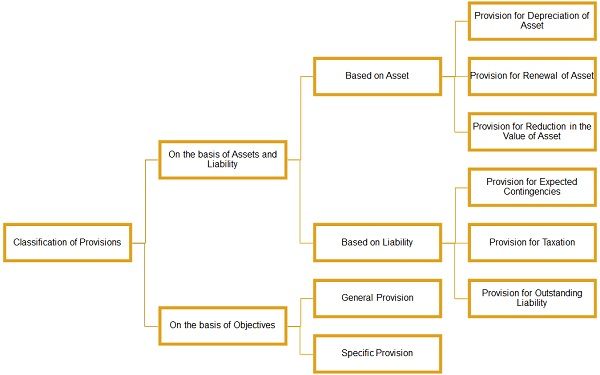

Classification of Provisions

Disclosure

While provisions for assets appear on the asset side of the Balance Sheet by subtracting it from the respective assets. However, provisions for liabilities appears on the liabilities side.

Also Read: Difference Between Provision and Reserve

What is Contingent Liability?

Contingent Liability is not an actual liability but can turn out as a liability if an uncertain future event occurs. This means that the happening or non-happening of future events can only decide whether it is actually a liability or not. Because of their uncertainty, we consider it as contingent, i.e. doubtful liability. This may include:

- Value of bills discounted,

- Cases pending in the court of law,

- Guarantees undertaken.

It refers to possible obligations that result from a past event and whose occurrence is not certain. Moreover, these events are not under the control of the company completely.

Characteristics of Contingent Liability

- Uncertainty as to whether the amount will be payable at all.

- Uncertainty regarding the amount involved.

Example

Any legal suit against the company when it is uncertain whether the company will win the claim or not.

Disclosure

Contingent Liability appears as a note to the Balance Sheet. The firm can disclose it when there is a likelihood that the loss will materialize and a reasonable estimate is possible. In that case, it does not fall in the category of contingent liability, and the firm can create a provision for the same.

Assessment of Contingent Liability

Contingent Liabilities evolve in a way not expected by the firm initially. Hence, the firm assesses the liability at periodic intervals to ascertain if an outflow of cash has become probable.

However, if it becomes probable that the outflow of the resources will be required for an item which is previously categorized as a contingent liability, then in such a case, provision is recognized in the financial statements. Generally, the period in which it will appear is the one in which the change in probability occurs.

Also Read: Difference Between Bad Debts and Doubtful Debts

Key Differences Between Provision and Contingent Liability

The points listed below will explain the difference between provision and contingent liability:

- A provision is a present obligation of uncertain amount and timing, as well. Contingent Liability is a possible obligation that results from past events and whose existence will rely upon the happening or non-happening of the future event.

- Provision is a recognized liability whose occurrence is certain. As against, a contingent liability is an unrecognized liability. This means that we do not pass any accounting entry for such liability. This is because of the following reason:

- It is not foreseeable that the settlement of that liability will need an outflow of funds.

- An accurate estimation of the amount is not possible.

- The review of the amount of provision takes place at frequent intervals. If there is any change in the estimate, it is recognized in the financial statement of the period in which there is a change in the estimate. On the other hand, contingent liabilities are also assessed at frequent intervals.

- The occurrence of contingent liability is conditional or uncertain. Whereas the occurrence of provision is certain.

- Provision is accounted for at present and arises as a result of past events. Whereas contingent Liability is disclosed at present as a note to account for the outflow of funds which are likely to occur in future.

Conclusion

All in all, when the company’s management estimates that it is apparent that the settlement of the obligation will lead to an outflow of funds, it recognizes a provision. However, when the company estimates that it is less probable that any outflow of funds will take place, in that case, the company discloses it as a contingent liability.

Leave a Reply